This post will explain quicken alternatives. It seems difficult and time-consuming to manage your finances. However, it is rather simple because a number of apps and tools can automate procedures and reduce the amount of time needed. Quicken is the most well-known of these, but it’s not the only one.

They number in the thousands. I therefore compile a list of Quicken substitutes you might find helpful. In order to assist you compare Quicken to the competition, I also provided some information about it.

10 Best Free and Paid Quicken Alternatives

In this article, you can know about quicken alternatives here are the details below;

A personal finance tool called Quicken has been independent since 2016 and was formerly owned by Intuit.

You’ve probably heard of Intuit before because it owns the well-known accounting programme QuickBooks.

Anyone who wishes to organise their finances should use Quicken.

It enables you to see all of your financial information in one location.

Goal-setting and money management are other options.

Pros

A user-friendly funding solution that is accessible online and through smartphones.

Apps are available for Mac and Windows.

For iPad and Android tablets, there is a free Quicken companion mobile app.

Both iOS and Android-compatible devices can use the mobile app.

View all of your accounts—banking, credit card, retirement, and investment—in one location.

Make savings objectives and realistic budgets that you can stick to.

View and manage your bills while making future plans.

It can also be used to manage your company’s finances.

Cons

It occasionally causes the app to lag due to problems.

The cost of the Windows and Mac programmes must be paid for separately; switching between platforms will increase the price.

Use the online version as a workaround.

If you are already a fellow, you can access it.

Users with Macs cannot purchase the Business plan.

No trial period or monthly plan exist.

The entire year must be paid for in advance.

Best Suited for:

People just starting out in personal finance, including employees, independent contractors, and business owners.

Plans cost $35.99, $46.79, and $70.19 annually.

For Windows alone, Home and Business costs $95.39 annually.

It provides a 30-day money-back promise but no free plan or trial is offered.

1. Mint

Mint is a tool for tracking spending and creating budgets that Intuit purchased in 2014.

Unlike Quicken, using Mint is cost-free. This is another Quicken Alternatives. Also check workflow management software

Although it is not as sophisticated as Quicken, it nevertheless has many helpful functions.

Pros

Use is free.

Apps for iOS & Android are both free.

Using this one tool, you can create a budget, track your credit, and track your spending.

Your data is protected by 256-bit encryption and multifactor authentication.

Features of Mintsights analyse data to offer individualised insights that can help you save more and spend more wisely.

Free credit score calculation

Cons

It shows advertisements for Mint partners.

As a budget planner and expenditure tracker rather than a full personal financial programme, it is less sophisticated than Quicken.

Best Suited for:

Those searching for a simple, free solution to keep track of their expenditures.

Free of charge.

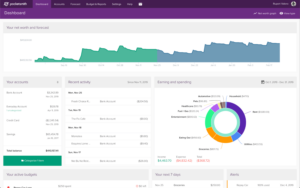

2. Personal Capital

A high-end financial planning and asset management app is Personal Capital.

You can check and plan your finances using its useful free plan.

There are wealth management functions in the commercial edition.

Real financial advisors also provide guidance here.

Pros

Get a complete sight of your finances by connecting your mortgage, loans, credit cards, savings, and 401(k)s in one location.

Your net worth will be determined by it.

You may plan your retirement, keep track of your money, and create a budget.

The ability to work with financial consultants who can analyse your finances and create a plan for you.

The largest plans have access to a group of investment professionals.

Cons

The free plan has restrictions.

Paid programmes with wealth management tools are pricey and need at least $100,000 in assets.

Best Suited for:

Individuals with an investing portfolio who make $100,000 or more per year.

Pricing: A free plan is offered to start.

Paid plans’ management costs are determined on earnings.

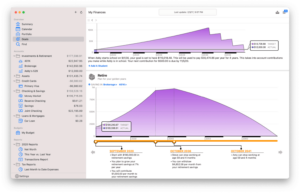

3. PocketSmith

A freemium personal finance programme is PocketSmith.

You may check the insights, view your financial accounts, and make future spending plans with it.

Pros

Use is free.

Connects to more than 12,000 universities globally.

Transactions from many sources can all be seen in one location.

Your expenditure can be categorised, labelled, and annotated so that you can find it quickly in the future.

Connect to your Xero account and transfer costs there.

Make estimates, anticipate financial flow, and plan your spending.

Even transactions and other data can be imported from Mint.com.

Cons

The free plan has restrictions, and the paid plans are reasonably priced.

Understanding all of the features can take some time.

Best Suited for:

Entrepreneurs and independent contractors who need a personal financial app.

Pricing: Monthly fees for paid plans are $9.95 and $19.95.

A free plan is also offered.

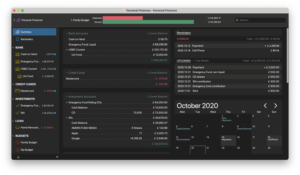

4. MoneyDance

Software for managing personal finances called Moneydance is multi-platform and multi-lingual.

It makes use of a double-entry accounting method. This is another Quicken Alternatives. Also check password generator software

Pros

Works with a variety of gadgets.

There is software for Linux, macOS, and Windows.

There are apps for both iOS & Android.

It can be used to plan budgets, manage finances, and keep track of investments.

Graphs and reports that are simple to interpret are used to represent all of your data.

It enables you to create payment plans for both one-time and recurring transactions.

Very reasonable

Cons

A new user interface is required.

Has fewer functions than the more sophisticated finance tools.

Non-accountants who want a double-entry bookkeeping system are the best candidates.

Pricing: $49.99 one-time cost.

A 90-day money-back guarantee is offered.

There is also a free trial with constrained features available.

5. YNAB (You Need A Budget)

Another well-liked personal budgeting programme that runs on several operating systems is YNAB.

You can use the software to save every dollar for a certain requirement.

This enables you to long-term budget more effectively.

Pros

Includes support for the web, Android, iOS, Apple Watch, and Alexa from Amazon.

You can include credit card, checking, and savings accounts and examine all of your finances in one location.

It makes visualising your finances simple.

The information can be used to make a budget, set goals, and organise your spending.

Includes starting-point video courses.

Cons

It’s a little pricey.

When compared to other financial instruments, it is a distinctive method that has a slight learning curve.

Best Suited for:

People who have been dissatisfied with alternative financial tools and apps.

Price: $84 per year or $11.99 each month.

There is a 34-day free trial available.

6. HomeBudget

Anishu’s HomeBudget is a programme for managing household expenses.

It functions on a variety of gadgets, including Kindle. This is another Quicken Alternatives.

Pros

Works on mobile and desktop PCs.

In addition to apps for Kindle, Android, iOS, and Windows, software is also available for macOS and Windows.

It is quite inexpensive.

A few dollars are required.

It is simple to use. It is properly organised with categories and subcategories.

Cons

Several of the other tools on this list have more features than this one does.

Best Suited for:

Anyone searching for a premium, reasonably priced expense-management tool for houses.

Prices: Vary depending on the gadget.

The prices for the Kindle and Android editions are $5.99 and $19.99, respectively.

Both the Windows and macOS versions cost $14.99 and $24,99 respectively.

For all devices, there are trial versions available.

7. Banktivity

For Mac and iOS users, Banktivity.com offers a cost-effective personal finance management programme.

A wide range of users will find its numerous functions and settings suitable, and new features are constantly being introduced.

Pros

Connect different financial accounts, then logically group and sub-group them all.

It has connections with more than 14,000 banks worldwide.

View your accounts, set objectives, and prepare a monthly budget.

You can use it to keep tabs on your financial portfolio and home worth.

Different devices’ apps sync with one another.

Even if you decide not to continue your subscription, you can still access your data.

Cons

No Linux, Windows, or Android versions exist.

There isn’t a monthly schedule.

Annual payments are made in advance. Users of the Mac, iPad, and iPhone are best suited.

Price points are $49.99, $69.99, and $99.99 annually.

8. DollarBird

Families that want to collaborate on budgets would benefit greatly from using Dollarbird, a calendar-based personal money management tool. This is another Quicken Alternatives.

Pros

The calendar allows you to track transactions from the past, the future, and recurrent events.

You can categorise your transactions and finances with the use of built-in AI.

Daily balance calculation that aids in evaluating your current and future financial status.

To help you organise your schedule and create a budget, invite your family and financial experts.

Cons

The programme requires a lot of work because you have to manually add your finances.

Budgets cannot be set.

There are few possibilities for customer service.

The features are quite simple.

Best Suited for:

Individuals seeking a simple, portable, calendar-based personal finance solution.

Pricing: The Pro plan has a yearly price of $39.99 or $4.99 per month.

There are also Free and Business plans available.

9. GoodBudget

A household budget tracking programme is called Goodbudget. Also check Cybersecurity Software

It aids in the application of the envelope method. This is another Quicken Alternatives.

You create envelopes for various categories, including groceries, bills, rent, and eating out, in this step.

Then you keep the money in the envelopes and use it as needed.

Pros

Software that makes it simple to use the well-established envelope method.

Versions on the web, iOS, and Android.

Syncing of spending data with family accounts.

Free programme is offered

Cons

It only works for those who want to plan their budget using the envelope system.

It’s not the best programme for budget tracking.

People who want electronic support for the envelope method are the best candidates.

Price: $7 monthly or $60 yearly.

There is a free plan offered.

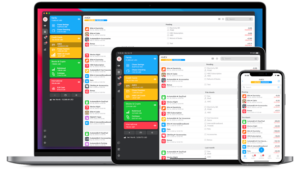

10. MoneyWiz

Popular and effective, MoneyWiz syncs with more than 40,000 banks in more than 50 countries.

Additionally, it communicates with programmes like Plaid, Yodlee, and SaltEdge. This is another Quicken Alternatives.

There are numerous additional options that make managing your cash easier.

Pros

Applications for PC, Mac, Android, and iOS.

You can manually add transactions or sync transactions from all the banks.

All world currencies, including cryptocurrencies, are supported.

Put everything in order by categorising and assigning colours.

View your portfolio’s performance over the past few years.

Supports a range of budgeting techniques, such as the envelope method.

Cons

Users who have never used a money management application before may find the sheer quantity of features to be overwhelming.

Best Suited for:

Those seeking sophisticated money management software.

Pricing: Free trial for one week.

For iOS and macOS, MoneyWiz 2021 costs $19.99 and $49.99 annually.

The one-time cost of MoneyWize 3 for iOS, MacOS, Android, and Windows PC is $9.99 for mobile devices and $49.99 for desktop.

For $49.99 a year, a membership (with extra features) is offered.

The average annual subscription costs $19.99.

A monthly premium subscription costs $4.99, or $49.99 annually.

Which Quicken substitute do you prefer?

It will take time to regularly reflect on your financial situation. But over time, that little bit of time you set aside each week will help you arrange your finances. It will lessen the tension in your life.

In order to test out some of the Quicken alternatives listed above, be sure to join up for free plans or trials.

Choose your favourite, and then continue with the complimentary plan or upgrade.

Pay attention to the insights as you plan and monitor your finances both now and in the future. You might like to take a glance at iFinancer, which is another another fantastic income and expense tracker.