This post will explain payroll software. We can help if you’re looking for a new payroll system. Here are 14 of the top payroll software programmes for small businesses that you should think about using, ranging from basic payroll to complicated payroll, tax filing to handling employee benefits.

The 14 Best Payroll Software Solutions For Small Businesses

In this article, you can know about payroll software here are the details below;

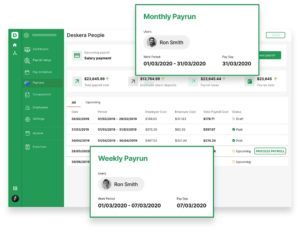

1. Deskera People

Deskera People describes its software as the “easiest online payroll software for small business,” noting that it is simple to operate and has a low learning curve for managing payroll, spending, hiring, and leave and time-off.

Top qualities:

Processing payroll in three steps with unlimited off-cycle pay runs

Flexible pay schedules that make it possible to swiftly and conveniently pay all employees who are assigned to a particular schedule

components of individual earnings and deductions, including bonuses

A drag-and-drop creator for pay stubs, wage slips, and pay slips

A very straightforward three-step procedure for moving your data to Deskera

Deskera People is payroll software.

From Deskera

Pros:

Using an intuitive user interface, managing payroll is quick and uncomplicated.

Includes payroll reports and a thorough dashboard that displays payroll expenditures for the previous month and the entire year, upcoming runs, cost projections, etc.

Available for both companies and employees on mobile devices running Android and iOS

Cons:

Deskera mostly provides email and chat help; if you prefer to place a call when you require customer service, it will be an adjustment.

Only the USA and Singapore have built-in legislative and tax compliance at this time.

Best for:

Deskera People, in the words of the firm, “offers enterprise-level functionality [at] small business price.” As a result, it is excellent for startups and small enterprises as well as capable of meeting the needs of expanding mid-sized and enterprise companies.

Pricing: There is no commitment required to sample Deskera People for free for 15 days. After that, the price per user will range from $49 to $229 per month (or $39 to $199 per month if annual plans are more your style).

2. Agiled

Agiled is among the best all-in-one utilities available. Payroll can be run (of course). However, there are a tonne of additional things you can do, such as use the CRM to manage your contacts, make contracts, send bills, organise company money, and manage workers. This is another payroll software. Also check remote desktop software

Agiled can assist you in reducing the number of tools you use to operate your business from 201 to one or, at most, a couple.

Top qualities:

With choices to use attendance logs, include or exclude expense claims, mark absence days as paid or unpaid, etc., payroll processing is done in three steps.

Thanks to teammate profiles, payment information, timesheets, and employee documentation are all in one location.

Inventor: Agiled

Pros:

Agiled is an all-in-one business management solution, thus it has everything you need if you’re interested in topics other than payroll and HR.

Integrates with applications like TimeCamp, TransferWise, Xero, Zoho Books, and QuickBooks

Cons:

Compared to rivals, the payroll functions are basic.

Only the Premium and Business plans include payroll.

Agiled’s support documentation is lacking in comparison to more in-depth materials from other payroll software providers in terms of getting down to the nitty-gritty.

Best suited for: Medium-sized companies without a lot of frills.

Price: A Premium or Business plan is required to access payroll functions; these plans cost $45 per month or $79 per month, respectively. The AppSumo lifetime bargain is even better; you can get it for as little as $69—what a value!

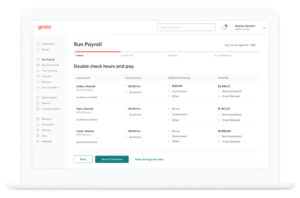

3. Gusto

Over 200,000 companies love and utilise Gusto. Even though it isn’t quite as fancy as Agiled, it performs more than just payroll. It does a terrific job and also aids in HR. It was named the top HR and payroll platform by Nerdwallet in February 2022.

Top qualities:

Payroll on AutoPilotTM lets you perform unlimited payroll either manually or with a few clicks.

Automatic federal, state, and local payroll tax filing

Benefits that instantly integrate with your payroll and built-in time tracking

Employee interface that is easy to set up and includes built-in financial features like savings and emergency funds

Payroll application – Gusto

Origin: Gusto

Pros:

Full-service payroll system to manage time tracking, workers’ compensation, PTO, and more that connects with applications like Xero, Clover, and QuickBooks Time

Ability to manage small business health benefits, including medical, dental, and vision, through Gusto

Being able to pay contractors in an astonishing 80+ countries allows you to access talent throughout the world.

Cons:

Customers service and the onboarding process both need improvement, according to some users.

Reporting features might be made easier.

Support for compliance may be weak, particularly when problems arise

Best for:

Gusto is a wonderful option for all kinds of small businesses and NGOs, regardless of whether they have basic payroll and HR requirements or more complex ones involving salaries, compensation, and pay schedules.

Price: The monthly plans for Gusto start at $39 plus $6 per person.

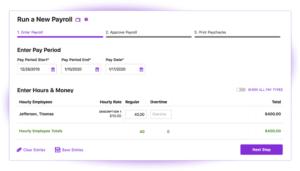

4. Patriot

Another excellent payroll programme that can help you save hundreds or even thousands of dollars annually is Patriot. You only need to follow three steps to run payroll, same like with Deskera.

Additionally, each new tax calculation undergoes 20,000 tests before to being included in Patriot’s software. In light of the fact that your payroll reporting is as accurate as it can be, you can relax.

Top qualities:

Unlimited payrolls and no-cost payroll setup

A tool for net-to-gross payroll

Tax filing for local, state, federal, and year-end taxes (accuracy guaranteed)

Patriot Payroll Software

Origin: Patriot

Pros:

It is perfect for non-accountants because it is user-friendly and mobile-friendly.

Assistance for companies with several locations

Simple departmental payment

Ability to modify pay rates, pay frequency, money, hours, and deductions

Cons:

If you file in numerous states, you’ll have to fork over extra cash for e-filing 1099s and additional state tax forms.

Administration of benefits and HR services are not included, unlike with comparable software like Gusto.

Payroll reports are not very configurable and somewhat basic.

Best for:

US-based small businesses looking for an affordable, straightforward payroll solution.

Pricing: The Full Service Payroll plan is $37 per month + $4 for each employee or contractor, while the Basic Payroll plan costs $17 per month. If you’re unsure of which package you require, you can use the software for a 30-day free trial.

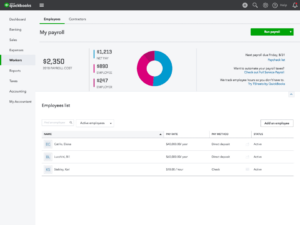

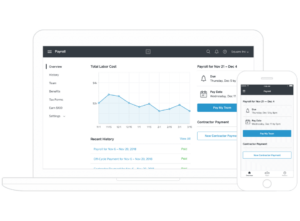

5. QuickBooks Payroll

If you’ve ever used or considering using TurboTax, you’re probably already familiar with Intuit, which makes QuickBooks. Using QuickBooks’ payroll services is a no-brainer for many users because it is one of the most widely used accounting programmes. You can “access HR and benefits with the #1 payroll service provider,” in particular.

Top qualities:

Direct deposits made today and tomorrow

Payroll software

To save you time, use auto forms and taxes (and frustration)

Quickbooks payroll software for payroll

From Capterra

Pros:

24/7 customer support, including professional setup

Access to employee services like 401(k) plans, workers’ compensation, health benefits, and HR assistance

A accuracy warranty and up to $25,000 in tax penalty protection

Cons:

If you want more integration possibilities, you’ll need to combine it with QuickBooks online because it doesn’t have many integrations or add-ons beyond other Intuit products.

It is dangerous to move data from another platform, so the QuickBooks team only verifies Premium plan data for accuracy and only transfers Payroll Elite data. Also check data analyst tools

Best for:

Small to mid-sized US-based enterprises, nonprofits, and accountants can use QuickBooks Payroll. If you already use QuickBooks for your bookkeeping, that is ideal.

Pricing: Plans for QuickBooks Payroll begin at $70 per month plus $4 per employee (but you can often snag a half-off deal on their website). This is another payroll software.

6. OnPay

OnPay provides one of the most adaptable options on this list and is supported by payroll specialists. From small and medium-sized enterprises to the accountants who support such companies, the software is “intended to be accurate for everyone.”

You can customise OnPay to be whatever you require if you don’t want to waste time looking for the ideal option.

Top qualities:

Multistate payroll and unlimited payroll runs (available in all 50 states)

Payment options include checks, debit cards, direct deposits, and a variety of pay rates and schedules.

Accounts for lifetime employees’ self-service and self-onboarding

Custom reporting and the report designer

Payroll services that are unique

Payroll application – OnPay

From Capterra

Pros:

Truly full-service, including all the payroll capabilities a small business would require in addition to HR tools and benefits management

Integrates with more than ten of the industry’s top solutions for compliance, time tracking, HR, and accounting

Accuracy is ensured with free account migration and integration setup from customer support.

Cons:

OnPay is not advised for workers outside of the US.

There is no mobile app, therefore everything must be done on a desktop.

Best for:

Small and big US-based enterprises with unique payroll requirements, such as nonprofit organisations, eateries, and firms with more than 500 employees, should use OnPay.

OnPay’s price is really straightforward. There is a single, all-inclusive pricing option that costs $36 a month + $4 per person.

7. Square Payroll

One of the most well-known names among local small enterprises is Square. However, you can use it for a lot more than just accepting money.

You can use Square Payroll as a single tool to access full-service payroll, automatic tax filings, and employee benefits. Additionally, you will always have access to live payroll experts.

Top qualities:

Multistate payroll processing in five steps for both employees and contractors

Integrations for commissions, tips, and timecards

Hourly, wage, or other amounts as needed

Payroll tax filing for local, state, & federal taxes

Square Payroll is payroll software.

Pros:

There are no long-term obligations, so you’re never tied down.

Integrates with other Square products, such as Team Management and POS,

Integrates with additional products like timecard tools and QuickBooks Online

Payroll experts are on hand to respond to inquiries

Cons:

No possibility to alter payroll dates

Some customers claim that, in comparison to similar software, the employer dashboard is rudimentary.

Response times for custom services can occasionally be a little slow.

Best for: Brick-and-mortar businesses that use Square as a POS, small enterprises that exclusively employ contractors, or establishments where workers clock in and out are all obvious candidates for Square Payroll.

Pricing:

Square Payroll offers various pricing plans for users that pay both employees and contractors as well as users who simply pay contractors. Pay Employees & Contractors begins at $35/month plus $5/month per person, while Pay Contractors Only begins at $5/month per person.

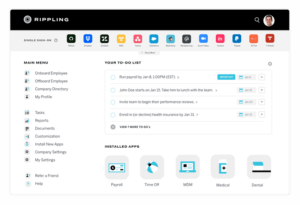

8. Rippling

Rippling performs payroll in less than a minute, giving the quote, unquote “easiest” tools a run for their money. According to the business, Rippling is “payroll so strong it can run itself.” Literally.

Rippling is a good (and quick) payroll alternative because time is of the essence, especially when you have a million other business-related chores to attend to.

Top qualities:

Worldwide payroll services for workers and independent contractors

Payroll may be started at the press of a button thanks to HR data synchronisation.

Automatic tax filing and compliance

Custom and already-built reports

Payroll software – Rippling

Technology Crunch

Pros:

Payroll processing takes just an average of 90 seconds with Rippling.

You can automate hundreds of tasks linked to payroll with the aid of customizable process templates.

More than 400 integrations to streamline your processes and maintain data synchronisation

Cons:

There is currently no easy way to change your tax exemption and filing status, which could result in you overpaying or, worse yet, underpaying your taxes.

Some consumers find the mobile app difficult to navigate, thus they prefer the desktop version.

Best for:

With single sign-on (SSO) capabilities and payroll control, Rippling is the best option for small to mid-sized organisations looking for contemporary software.

Pricing:

Rippling starts at $8/month per user, however there may also be a base price for the product you’re interested in. The Rippling team can inform you of Payroll rates if you get in touch with them.

9. Wave Payroll

Wave is a dependable, user-friendly application for managing finances for independent contractors and small business owners. So it should come as no surprise that Wave Payroll is a user-friendly, dependable solution for ensuring that your crew is paid. This one is certainly worth examining into if you conduct business in the US or Canada. This is another payroll software.

Top qualities:

Automatic payroll journal entries

Self-service tax forms and pay stubs

For owners of small businesses, payroll processing, reporting, time monitoring, and workers’ compensation are designed.

Wave Payroll is payroll software.

Payroll Wave, Inc.

Pros:

Because payroll and accounting systems are linked and synchronised automatically, there is much less need for human bookkeeping.

Pay only to active workers (unlike other platforms where you may have to pay for employees whether or not they are active)

You may test it out for free for 30 days and there are no setup costs or other surprises.

Cons:

In all (or possibly most) states, automatic state and federal tax filing is not currently accessible.

Only chat and email support are offered right now.

Best for:

Small business owners that use Wave for bookkeeping and wish to add seamless payroll services will find that Wave Payroll works well for them.

Pricing:

The cost is $35 per month + $6 for each paid active employee or contractor in the 14 states where tax filings and payments are possible. It costs $20 per month + $6 for each paid active employee or contractor in self-service states.

10. Sage HRMS Payroll

Sage is more complex than other options on our list, so it is wise of it to not make the claim that it is a straightforward answer. The company’s marketing, however, centres on accuracy and speed. Therefore, don’t write Sage off if you want to ensure that your payroll management is “flawless.”

Top qualities:

To print “out-of-the-box ready-to-print checks,” use Sage Payroll CheckPrint.

Creating custom checks using SAP® Crystal Reports

Payroll tax forms and electronic filing to avoid mistakes in tax preparation and failure to comply with local, state, or federal reporting and payment requirements

Automation of payroll timecards for simple importing and labour data validation

Sage HRMS Payroll is a payroll programme.

Citation: Sage HRMS

Pros:

Sage HRMS is offered as a stand-alone system or as a component of Sage 50 cloud Accounting, which also offers small business accounting and finance tools and HR and payroll solutions.

Simplifies the process of timely, accurate internal payroll management

Sage University is one of several resources available to you to help you utilise the software expertly.

Cons:

There is a small learning curve to set up and utilise the tool to its maximum capacity.

Despite Sage’s software to make other taxes simpler, several users have expressed disappointment that they cannot use it to file local taxes.

Sage is most effective for small to medium-sized firms that handle their own internal payroll.

For price information, get in touch with the Sage team.

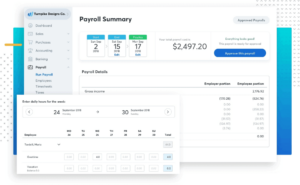

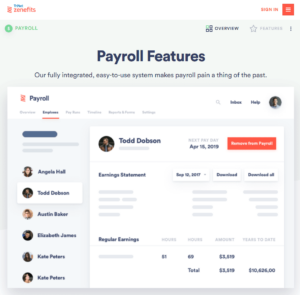

11. Zenefits

Zenefits is a straightforward, user-friendly application that reduces the time you spend on payroll administration. The business asserts that it can handle the special circumstances of any type of business, “from one-man shops to thousand-person organisations.” This is another payroll software. Also check live streaming software

Zenefits does, however, allow users make the final decision by providing free personal demo accounts. You can then determine if the software will actually satisfy your specific requirements.

Top qualities:

Unlimited pay runs, pay previews, and adjustable pay stubs are available.

To analyse data by role, department, location, etc., there are many pay rates and labour codes available.

Withholding with garnishment

New hire state filing, automatic federal and state filing, and tax compliance

Payroll application: Zenefits

Pros:

integrates with a huge number of the programmes and services you already use, like Xero, QuickBooks, Zapier, and others

Has a group of payroll specialists who provide advice

To manage employee benefits, you can either use your own broker or a broker partner of Zenefits.

Cons:

To use Payroll, which is an add-on, you must have a base Zenefits plan.

Some customers have complained about the support team’s lengthy response times.

The company’s own words are “From one-man shops to thousand-person enterprises, our payroll is built to handle your particular circumstance,” therefore this is who Zenefits recommends it for.

Price: Each employee pays just $6 a month for the payroll add-on. The per-employee base monthly price ranges from $10 to $27.

12. Wagepoint

Wagepoint remains authentic. The organisation understands that running a payroll probably wasn’t in the owners’ business ownership plans for small companies and accounting firms. It’s a hassle. This is another payroll software.

By automating the procedure, Wagepoint’s payroll software addresses that issue and enables you to cross it off your to-do list with a single click.

Top qualities:

Automated calculations for income, deductions, and other things

Automatic tax remittances and calculations

Online employee portal with 24/7 access to pay stubs, tax documents, and direct deposit information

Simple electronic submission of year-end documents such as 1099s and W2s

Workers’ compensation that is pay-as-you-go

Wagepoint is payroll software

Founder: G2

Pros:

Complete payroll system that aids in setting up records of employment, processing payments, and integrating new personnel (ROEs)

Industry- and bank-grade security to safeguard any critical data

Excellent customer service team to assist with issues and software navigation.

Cons:

Setup may require more time than other options

To satisfy specific business demands, some users say they’d want more customization possibilities.

Compared to competing software like Zenefits, has less integrations

Best for:

Small businesses can utilise Wagepoint’s online payroll programme internally or through accounting and payroll specialists who work with small business clients.

Pricing:

The cost of Wagepoint is determined by how many employees you have and how frequently you pay them. The price calculator indicates that the per payroll expense for five employees receiving biweekly pay is $30. And the best part is that you may use a credit card-free trial of the software up until you run your first payroll.

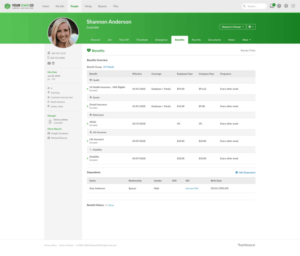

13. BambooHR

BambooHR, which focuses on US-based workers, offers a straightforward approach to pay your team promptly every time. A late paycheck is disliked by all. But in order to pay the staff on time, you don’t want to spend hours processing payroll (or hours filing taxes). This is another payroll software.

Therefore, BambooHR lessens the amount of manual work you must do, keeping you and your staff content.

Top qualities:

A platform for employees’ self-service where they may view information about their payroll, such as pay stubs and direct deposit accounts

You may rapidly access more than 100 detailed reports so you’re never in the dark about labour costs.

A three-tier backup redundancy strategy, cutting-edge data encryption, ongoing monitoring, and a variety of data centres are all part of the highest level of data protection.

BambooHR is payroll software.

Pros:

Payroll and BambooHR sync wages, hours, account numbers, benefits, deductions, and withholdings so that your data is always up to current.

Employers and employees may get the information and services they need on any device thanks to Android and iOS apps.

BambooHR completely takes care of your local, state, and federal taxes to save you time and ensure that you are complying with all tax laws.

Cons:

Users have asked for enhancements to and improvements to the user interface, such as greater search functionality and the capacity to arrange employee documents by folder.

Additionally, it appears that there is a dearth of onboarding assistance and software usage documentation.

Compared to some other online payroll software systems, not as flexible or configurable

Best for:

Businesses in the US with little time might benefit greatly from BambooHR. I’ve been handling payroll for more than 25 years, one user even claimed. I have never operated a payroll scheme that offers this level of consistency and service. Every payroll period, switching from a competitor to [BambooHR] has saved me an entire day.

If you’re interested in this software, you must request a quote. Don’t worry though, the quotation is free.

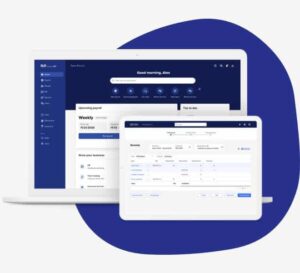

14. RUN POWERED BY ADP

RUN is the final option, and it is used by almost 800,000 small business clients. Over the years, it has won over ten awards, one of which was for its mobile employee app. More than 2 million people have rated the app, which has an overall rating of 4.7 in the App Store and 4.5 on Google Play.

This software can not only make your life simpler, but it can also make your employees’ lives simpler. Everyone benefits! This is another payroll software.

Top qualities:

Flexibility in pay options, multijurisdictional payroll, and recurring payroll

Potential errors are flagged by AI-powered error detection technology before they can cause issues.

Providing easy access to pay, scheduling, and benefit information for staff members via mobile devices

We handle your payroll tax calculation, filing, depositing, and reconciliation.

RUN Powered by ADP® Payroll Software

An ADP source

Pros:

Flexible packages that grow with you ensure coverage regardless of whether you only need the bare minimum in payroll or the full nine yards.

RUN has step-by-step screens, instructions, and advice for important tasks, making it similar to TurboTax for payroll and HR.

AI gets to know your company, foresees your needs, and verifies the accuracy of your payroll.

Cons:

Certain reports, according to some users, are difficult to access and could be more customizable.

There is no time limit after submission for fixing mistakes or making edits, even if your payroll hasn’t yet been processed.

RUN can be quite expensive for really small businesses.

Best for: Companies that manage payroll internally and need smart features to make the process simple will love RUN.

Contact the ADP team for pricing information, and they will provide one.

It’s time to choose your new payroll software.

Both you and your employees don’t want to be stressed out about managing payroll. Therefore, a small business payroll system can make it easier for you both to breathe. However, there are countless payroll service providers available, many of which are not listed here, such as Paychex Flex, Xero, and Paycor. How do you decide?

You can quickly compare your options with AppSumo and get the knowledge you need to choose the best option for your company. Not to mention, you can save a tonne of money if you can find an annual or lifetime deal for the software you require in the AppSumo store. Payroll processing tools are always being added to the store, so keep an eye out for them!