Best Apps Like Grain Credit will be discussed in this article. Apps like Grain Credit are quite popular for iOS and Android users who want to get credit cards without running a credit check. Thus, you will more likely find what you need on the market. Yet, you have to use those apps responsibly and avoid any unnecessary things. In this article, you will find a series of apps that offer similar services to Grain Credit. It means that you have plenty of options out there. Before sticking to one platform, you should check all the features and benefits offered in the first place, considering not all apps are made equal.

Best Apps Like Grain Credit for Android and iOS

Have you heard of Grain Credit in the first place? Well, this app provides an alternative to credit cards. If you cannot apply for traditional credit cards – especially issues like credit score and similar things, then you can consider this alternative, for sure. The system can determine how much you can spend depending on your income. The good news is that you have more options on the market – Gain Credit is not the only app that offers credit card alternatives. Find out what you can choose on the list below!

Top 11 Best Apps Like Grain Credit And Similar Apps

In this article, you can know about Apps Like Grain Credit here are the details below;

1. Tellus

One of the apps similar to Grain Credit that helps you to build credit is Tellus. You can download this platform for free while the features are quite rich to enjoy. Other than providing financial help, this platform offers services to create a financial portfolio.

Thus, you can get the money you need and establish investments by using Tellus. You can make money by incorporating Tellus because it provides up to 3% APY. Many users choose this platform to finance their property management. Other than that, this app will be the best platform if you are a property owner who rents the places to others. Feel free to check out this app and find out whether or not Tellus is for you.

2. Chime

There might be many apps like Grain Credit that offer a credit card alternative. According to users, Chime is one of the best platforms that should be on your list. It comes with a series of features, one of which is allowing you to use a credit card – without a physical card in the first place.

However, you have to register for the Chime Spending Account. It is a checking account that will allow you to get the credit-building feature. Once your account is set, you can transfer the money to this account from another. It will act as your credit limit.

Having an account also turns on the automatic payment feature. Chime doesn’t charge interest rates and other hidden fees. This is why you must open an account on this platform. As long as you pay the bill within the timespan, your credit score will improve.

3. NerdWallet

Are you looking for a reliable digital credit line? If so then you have to take a look at NerdWallet as well. This finance platform is generally a financial tracker which allows you to use your money at best. All the information about your financial state is accessible on one screen.

By that, you will know how much left you have in your budget. Generally, this app allows you to know your spending habits. Later, you can decide which part you can cut and how to manage your budget in the future.

Also, NerdWallet is an excellent app you can rely on when you need to check your credit score. In case something changes, the app will notify you instantly. This budget monitor app is as practical as it sounds, for sure.

4. Earnin

It is impossible if you haven’t heard of Earnin. This platform is one of the most popular instant credit line apps. Also, many users incorporate this app for cash advances. Long story short, Earnin is a loan app that provides you money without running background and credit checks.

After downloading and installing the app, you need to connect it to your active bank account. This will help the system to determine how much you can spend. Also, Earnin will analyze the time that you get paid.

As part of the apps similar to Grain Credit, Earnin needs to track whether or not you are at work. This is why the GPS account will automatically track where you are at. You need to do this so that this app releases the credit for the funds. Later, you will make an automatic payment once your paycheck arrives. Earnin is a free app but you can always leave a tip – it’s optional. However, Earnin is not a tool you can use to build credit.

5. Brigit

The name of Brigit is not a stranger for those who’ve been using online banking apps. Other than that, many companies or employees use this app for cash advances – it offers up to USD250 without any overdraft fee.

As one of the best free credit line apps for both iOS and Android, Brigit won’t run any credit check on users. Thus, you can get cash advances without interfering with your credit. Other than that, as long as you make the payment right in time, you don’t need to deal with the interest at all.

As mentioned earlier, Brigit is a free app. Yet, this platform offers a paid membership that offers sweet perks, such as flexible repayment, instant transfer, finance advisor, and many more – it costs USD9.99 per month.

The company also claims that users who use this platform and have a good payment history, can improve the credit score up to 60 points. So, if you think you can manage with the terms and conditions, go check Brigit now.

6. Unifimoney

Today, you may find the line of credit apps for smartphones, both on the Play Store and App Store. Talking about apps like Grain Digital credit card, Unifimoney is worth considering too. Some of you may have attended of this platform but it’s not as popular as Earnin or Chime.

To use the features offered by Unifimoney, you have to connect your checking account when registering with Unifimoney. Other than allowing you to have a credit line, you can use this platform to invest in cryptocurrencies as well as previous metals.

Generally, Unifimoney is more like an investment app instead of merely being a credit card – without checking your credit score in the first place. Yet, you can opt for using this app to make passive income as well. This credit alternative app is available for free on both the Play Store and App Store. As its name suggests, Unifimoney is a platform where all the money you earn is unified.

7. Acorns

If you check the Grain Credit reviews on both the Play Store and App Store, you will see that Acorns is quite reliable. But as mentioned earlier, this is not the only option you have. And if you are looking for an alternativ, Acorns will be a perfect candidate to consider.

This platform brands itself as a tool to save and invest at the same time. It also concludes that you can use Acorns to track your investments as well. Many users incorporate this app as a tool to diversify their portfolio, especially for retirement funds.

When you create an account, the system will come up with several questions. You need to answer all of those questions depending on your needs and Acorns will take care of the rest. Acorns is generally free to download and use. Yet, you can sign up for Acorns’ paid subscriptions to unlock more sophisticated features – the fee is quite affordable though.

8. Stash

The Grain app for Android phones is quite popular. Of course, that is not the only option you have when it comes to getting credit without credit checks. One of those platforms you have to consider is called Stash.

Stash is currently available for both iOS and Android phones. Thus, everyone can use this platform, especially for those who look for alternatives to get credit cards. One of the features offered by Stash is the finance advisor.

By using Stash, you can reach your financial goals easily. Other than allowing you to enjoy credit card services, you can also put your budget on different shelves. By that, you will have a budget for college funds, investments, and other things in one place. However, Stash is not a free app. You need to subscribe to one of the plans – starting at USD1 per month for the most basic plan.

9. Personal Capital

Some apps come up with a line of credit based on income. On the other hand, if you are examining for a tool to monitor your investments and finances as well as plan your retirement then Personal Capital is a good candidate. As mentioned earlier, this app comes up with a series of features that will be very useful for your financial being. Similar to Grain Credit, you can use this platform to diversify your portfolio. Thus, Personal Capital will be a perfect tool to manage your expenses and income – everything is accessible from one place. All you require to accomplish is to install this app and insert all the information needed. After that, the system will show you things you want to know as well as providing a space to start your financial state.

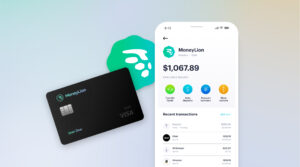

10. MoneyLion

Other apps like Grain Credit that you can check are MoneyLion. This platform is generally among the best cash advance apps that don’t run credit checks in the first place.

And by using MoneyLion, you can access various features, such as mobile banking, withdraw cash, investments, and many more. For the cash advance itself, you can get up to USD250 and there is no need to deal with interest rates as well as paying monthly subscriptions.

In case you want to build your credit, MoneyLion allows you to enjoy APR loans with a low rate – just make sure that you don’t miss the due payment. However, if all you need is to build your credit, you have to be part of the MoneyLion’s paid subscriptions.

Yet, you can unlock more features that will help you with financial matters. Also, compared to other apps on this list, this platform offers relatively low interest. So, if you are looking for a credit app that doesn’t require a credit check then you have to consider installing MoneyLion.

The presence of the Grain Credit app is such fresh air for lots of people. While building and fixing credit may require a series of hard work, the apps mentioned on the list above help to ease your burden. Still, make sure the app that you choose can provide the best service that offers features that fit your requirements.

And that’s a wrap – you can pick the best apps like Credit Grain that fit your requirement in the first place. Even though the process looks simple and straightforward, you should use the platforms responsibly. Once you’ve borrowed money, you have to pay it back in time, right?